財經書籍台灣翻譯得還不夠迅速、完整,因此本專欄不受限中文書籍,也將好的外文書推薦給讀者。

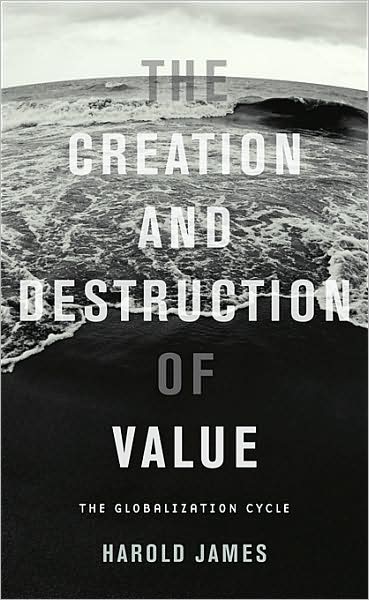

本書書名直譯為「價值的創造與毀滅:全球化的循環」;市面上講金融風暴的書很多,卻鮮少像本書以全球化的觀點談論,即使有也是論商品製造或勞務外包的全球化,而不是指全球化的金融市場。前幾期「每週好書讀」介紹過《1929大崩盤》這本書,講的是1929年美國股市崩盤造成的金融風暴,本書也提到1929,但1931年講得更多,因為1931全球景氣大蕭條的景況,和現在2009年很像,都是因美國金融崩潰造成的結果。我們可以看到價值不斷被全球化創造、毀滅,又再度被創造的過程,當資本主義走到這個地步,付出代價的是全世界;總體經濟的相關性遠比我們想像的還要高。

本書提醒我們認識金融市場的變化,提出讓市場更靈活的金融革命,改變我們看待金融的方式。

文章節錄

Reviewed by Hamish McRae

We are still too close to the financial meltdown of 2008/9 to be able to see it with much perspective. It is harder still to make much of an assessment of its long-term economic consequences, for the world has yet to emerge securely from recession. But we can begin to fit what has happened into some kind of historical template and that history surely gives us the most helpful way of understanding what might happen in the future.

History has already shaped the policy response to the recession. An international banking crisis that was, by general agreement, the most serious since the early 1930s demanded more effective policies than the world managed to muster that time round. The spectre of the 1930s depression has hung over politicians, treasury officials and central bankers alike.

Unsurprisingly there have been a host of books about the banking crisis and its consequences. But they have mostly had a "whodunnit?" tone to them, seeking to explain what happened and apportion the blame, rather than giving us some feeling for how the world economy might dig itself out of the crisis and how effectively it might develop in the years to come. So Harold James new book deserves a special welcome for giving us a framework to try to do this, for he is an historian rather than an economist. He is Professor of History and International Affairs at Princeton University and so sees what is happening in its historical and global context. He also has a profound interest in the great economic story of our times: globalisation. One of his previous books had the provocative title The End of Globalization and that is reprised in his opening chapter here.

However, anyone expecting his new book to explain why this current crisis will end the burst of globalisation will be disappointed. His argument is more subtle and more interesting. The crisis may have that effect and there are certainly political forces at work that are damaging international economic co-operation. But such an outcome is by no means inevitable.

First, he looks back at what might seem to be the closest parallel to today, the events of 1929-1931. The issue then was that a US financial market plunge was allowed to lead to a global banking crisis and a subsequent economic catastrophe. His explanation of that particular sequence is quite encouraging in the perspective it gives us now. It is quite extraordinary how policy-makers managed to make a series of sequential mistakes in their responses, from failing to rescue banks, through introducing trade controls to keeping their currencies locked to gold. Not only did they manage to get things wrong but they did so in just about the worst possible order.

They may have made errors this time and Professor James is critical of the failure to find a way of rescuing Lehman Brothers. Put simply, the string of subsequent support measures cost far more than they would have done had there not been the systemic breakdown that followed Lehman's failure. But eventually, and at great cost, this financial breakdown seems to have been contained, whereas in the 1930s it was not. This message comes through clearly from Professor James' description of the sequence of events in New York the weekend the effort to save Lehman failed, and the global reverberations from that event. We know pretty much what happened but it is useful to have it pulled together in a single narrative. Where he adds most value is in his effort to put the crisis into its international political context, asking some tough questions on the way. Is the US, through its lax fiscal and monetary policies, facing global decline akin to that of Hapsburg Spain?

To what extent has the European Union been weakened by the rise of economic nationalism, as large member countries seek to protect their own workers, and push redundancies onto smaller ones? Might the Chinese, having seen the weaknesses of Western market capitalism, pull back from engagement with the world economy?